Asset Finance Solutions for Plant & Machinery

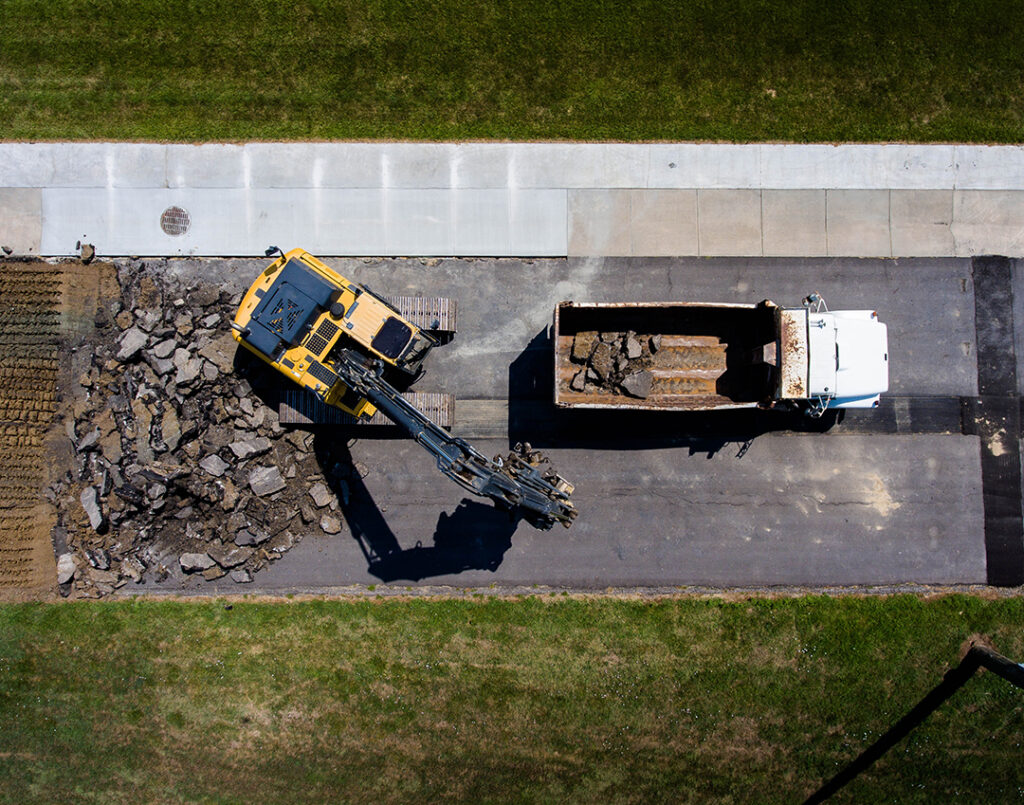

Plant and machinery play a pivotal role in various industries, driving productivity, efficiency, and innovation. From agriculture to construction, manufacturing to logistics, these assets are the backbone of modern businesses. In agriculture, specialised machinery ensures timely harvesting, increased yields, and cost-effective operations. In construction, heavy equipment enables the completion of complex projects with speed and precision. Manufacturing facilities rely on automated machinery to streamline production and maintain high-quality standards. In the transportation and logistics sector, fleet vehicles and handling equipment ensure smooth operations and timely delivery. Across industries, plant and machinery are vital for businesses to stay competitive, meet customer demands, and achieve sustainable growth. Their significance cannot be underestimated as they empower businesses to maximize efficiency, optimise processes, and drive success in today's dynamic marketplace.

In today's competitive business landscape, acquiring plant and machinery is often a crucial step towards growth and success. However, the upfront costs associated with purchasing these assets can pose significant financial challenges for businesses. That's where asset finance comes in as a valuable solution. Asset finance offers businesses a flexible and accessible way to acquire essential equipment without the need for substantial upfront capital. By spreading the cost of the assets over a defined period, businesses can enjoy the benefits of plant and machinery while preserving their cash flow and working capital. Whether it's upgrading existing equipment, expanding operations, or embracing technological advancements, asset finance empowers businesses across industries to unlock their full potential. In this guide, we will delve into the world of asset finance, exploring the various options available and demonstrating how it can be a game-changer for acquiring and utilising plant and machinery. Get ready to discover a smarter and more efficient way to fuel your business growth.

Asset Finance for Plant & Machinery

Asset finance is a specialised financial solution designed to help businesses acquire the essential plant and machinery they need to thrive. It provides an alternative to the traditional method of purchasing assets outright, offering businesses greater flexibility, accessibility and cost-effectiveness. With asset finance, businesses can secure the necessary funds to acquire plant and machinery by entering into an agreement with a financing provider. This agreement allows the business to use the assets immediately while spreading the cost over a defined period, typically through regular payments.

By utilising asset finance, businesses can overcome the significant upfront costs that often hinder their ability to invest in the latest equipment or expand their operations by spreading a figure across a greater period of time. Instead of tying up valuable capital in purchasing assets outright, businesses can preserve their cash flow and working capital for other essential areas of their operations.

Hire Purchase for Plant & Machinery

Hire purchase is an asset finance arrangement that enables businesses to acquire assets by making regular payments over a fixed duration. During the repayment period, the business is committed to purchasing the asset, and ownership is transferred once the final payment is settled. Typically, the finance company retains ownership until the last installment is made. Whether the hire purchase agreement is secured or unsecured depends on factors such as the asset's value and the borrower's creditworthiness.

Lease Purchase for Plant & Machinery

Lease purchase is a financing alternative that grants a lessee the opportunity to lease either a brand-new or pre-owned asset for a specific duration, with the added option to buy the asset at the lease's conclusion. Regular payments are made by the lessee to the lessor, which may encompass a portion allocated towards the asset's purchase price. Essential components of a lease purchase agreement include the asset's purchase price, the lease term's duration, as well as any prerequisites or conditions necessary for exercising the purchase option.

Finance Lease for Plant & Machinery

A finance lease, referred to as a capital lease, is an arrangement where the lessee (the entity leasing the asset) assumes responsibility for maintaining and insuring the asset throughout the lease period and holds the option to acquire the asset at the lease's conclusion. The lessee makes regular lease payments to the lessor (the entity owning the asset) over the lease term, comprising both an interest portion and a depreciation component.

The benefits of Asset Finance

- No need for large upfront payment

- Improve cash flow

- Tax benefits through claiming interest and depreciation

- In some cases, the expense of maintenance is borne by the finance company, not the borrower

- Asset finance releases capital for use elsewhere in the business

- Cost savings: Asset finance can be cheaper than other forms of business financing, especially for businesses that need to upgrade their equipment frequently

Choosing the right Asset Finance provider

When selecting an asset finance provider for your business, there are several factors to consider to ensure you make an informed decision. Look for a provider with a solid track record and extensive experience in asset finance. A reputable provider with industry expertise will understand your specific needs and offer tailored solutions. Assess the range of financing options offered by the provider and Consider whether they offer hire purchase, lease purchase, finance lease, or other suitable options that align with your requirements. Having flexibility in financing structures can help you find the most suitable arrangement for your business.

Compare interest rates, fees, and repayment terms among different providers. Seek competitive rates that are favorable to your business and ensure that the repayment terms are manageable and aligned with your cash flow. Further to this, consider the provider's application process and how quickly they can approve and disburse funds. A streamlined and efficient process is beneficial when you need to acquire assets promptly to seize business opportunities or address urgent needs.

Choose a provider familiar with your industry and the specific assets you require. Industry knowledge can make a significant difference in understanding your business's unique challenges and providing tailored financing solutions. Evaluate the level of customer support provided by the asset finance provider. Prompt and responsive customer service can be crucial in addressing any queries, concerns, or issues that may arise during the financing period. Consider the potential for a long-term relationship with the provider. Building a strong partnership can benefit your business in the future when you require further financing or have evolving asset finance needs.

How to Apply for Plant & Machinery Finance

If you're ready to get started with an application for finance for your Plant & Machinery business, the process is incredibly straightforward and you could get an idea on your likelyhood of acceptance within the hour. Our team is here to help find the best solution based on your business' needs and credit history. You can call us to speak to an advisor or use our quick online application. You may need to provide information about your financial status and history, personal details and identification materials.

Asset Finance and Refinance limited act as a licensed credit broker and not a lender, authorised and regulated by the Financial Conduct Authority. All finance is subject to status and income. Applicants must be 18 or over, terms and conditions apply, guarantees and indemnities may be required.

In summary, there's loads of great reasons why you should utilise Finance Lease, Lease Purchase or Hire Purchase asset finance for your Plant & Machinery businesses, most notably because of the improved cash flow, access to high-quality equipment and the tax advantages. Asset finance is more than just a financing solution; it is a powerful tool for businesses to maximise productivity and drive growth. By leveraging asset finance for plant and machinery needs, businesses can achieve enhanced efficiency by upgrading to modern, high-quality equipment; reduce downtime, and boost overall efficiency.

You can also gain a competitive advantage by accessing advanced technology and offering superior products or services, meet customer demands more effectively and outperform competitors. Asset finance aligns with the growth objectives of businesses. It provides the flexibility to scale operations by acquiring additional assets as needed. Whether it's expanding production capacity or entering new markets, asset finance supports businesses in their growth journey.

If you're a business in need of plant and machinery, exploring asset finance solutions is a strategic move that can propel your operations forward. By partnering with reputable asset finance providers, such as Asset Finance & Refinance Ltd (who are a broker), you can access the equipment you require without compromising your financial stability.

Remember, the benefits of asset finance extend beyond financial assistance; they directly impact your ability to compete, innovate, and maximise productivity. Explore asset finance solutions today and position your business for success in the dynamic landscape of plant and machinery-driven industries.